Welcome back to Decouple, the best source for cutting-edge analysis on clean energy, with weekly interviews by Chris Keefer. Watch on YouTube, Spotify, or Apple.

This week, we return to China. David Fishman, senior manager at The Lantau Group, joins me again to dissect the unprecedented scale of China’s electrification, which Fishman says is driven by a mix of state planning, brutal market competition, and strategic energy security concerns. Our discussion ranges from the world's largest hydro projects to a coal industry that refuses to die; the forces driving China's power sector; the balance between state planning and market competition; and how this all fits into the larger economic shift towards innovation-driven, rather than imitiation-driven, growth.

Watch now on YouTube.

We talk about

China as an “Electrostate” – The rapid electrification of industries and households, approaching developed country levels.

State Capitalism vs. Market Competition – How China's blend of strategic planning and brutal market competition fuels its energy expansion.

Hydropower Megaprojects – The construction of massive new dams, including the record-breaking Tibet hydro project, which Fishman notes is a “monumental engineering challenge with geopolitical implications.”

Coal’s Persistent Role – Despite a renewables boom, coal-fired power plants continue to be built, largely financed by coal miners themselves. Fishman explains that these plants are designed to outcompete older coal facilities, rather than expand total coal generation.

Batteries and Grid Storage – Fishman highlights the rapid decline in battery costs and the role of energy storage in balancing China’s vast and volatile power grid.

Manufacturing Efficiency – According to Fishman, China’s engineering workforce and hyper-competitive industrial sectors drive continuous technological improvement, often by relentless iteration rather than first-principles innovation.

China’s First Economic “Recession” – Growth slowing to 3–5% after decades of double-digit expansion, signaling a shift in economic priorities. Fishman argues this is less of a crisis and more of a natural economic correction.

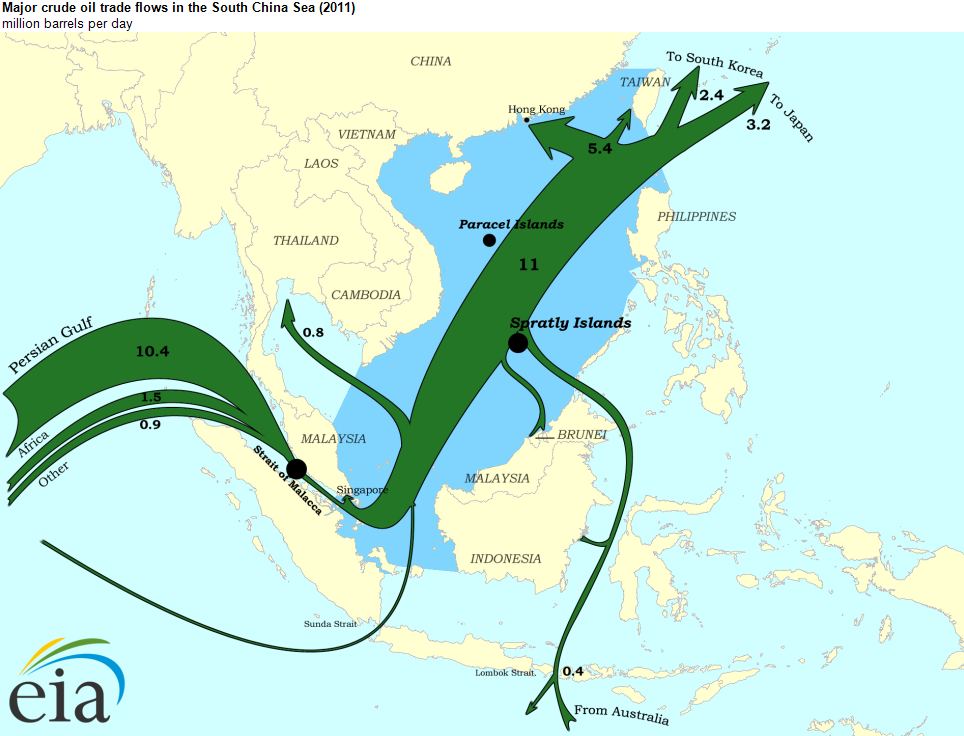

Energy Security and Geopolitics – The vulnerability of China's energy imports and how electrification is a strategic necessity, particularly in light of maritime chokepoints like the Strait of Malacca.

The Innovation Economy – Fishman says that China has moved from imitation to genuine technological leadership in key sectors like batteries and renewables.

The Role of Transmission Infrastructure – How high-voltage DC lines and strategic grid planning increase the viability of large-scale renewables, which Fishman describes as essential to reducing coal reliance.

“It actually takes innovation to get really good at copying things.” – David Fishman

For more background, check out my first interview with David Fishman:

Deeper Dive

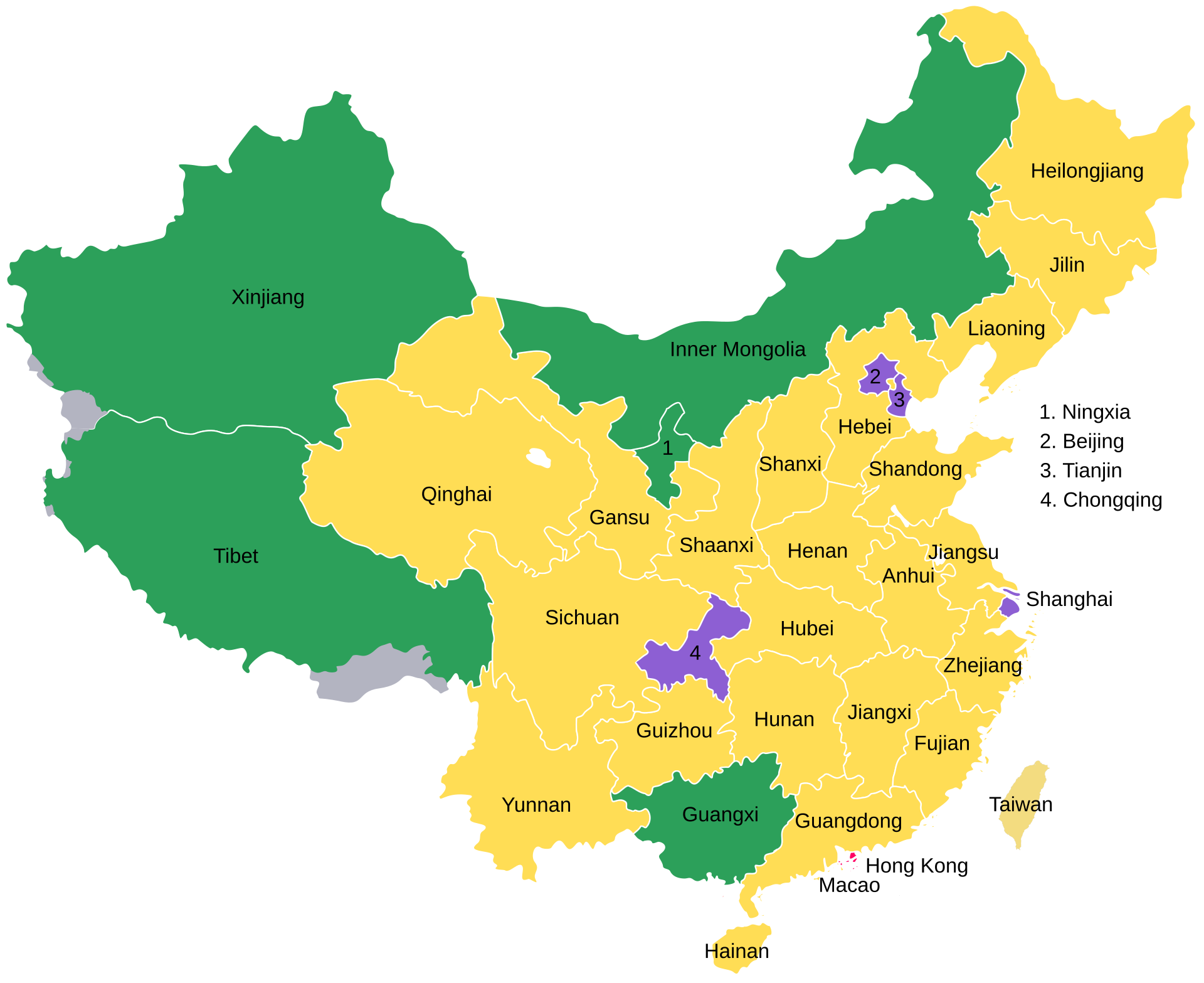

China’s transformation into a high-electrification economy is not an accident. It is the result of deliberate state planning mixed with fierce private-sector competition. On one hand, a central plan outlines which provinces shoulder the heavy lift of new power, from coal expansions in Inner Mongolia to brand-new hydro in Tibet. On the other, private Chinese firms tear at each other in brutal competition over razor-thin margins, fighting to refine every step of manufacturing.

The term “electrostate” captures a reality in which energy policy is more than just infrastructure—it's a national security imperative. According to Fishman, unlike other major economies, China doesn’t have the luxury of vast, domestically accessible oil and gas reserves. It relies heavily on imports, and its maritime access is constrained by geography and geopolitics, with 80% of its oil imports squeezing through the narrow Strait of Malacca. In response, the country has embarked on an unprecedented electrification drive, from mass deployment of renewables to a grid system designed to integrate them at scale.

“If China had the U.S.’s geography and resources, with its system, it’d already be unstoppable.” – David Fishman

For decades, Chinese policy primarily favored modernization at breakneck speed, and it stayed on that course for forty years. Now, even a modest dip to 3–5% growth feels like a “recession,” as Fishman puts it. That slowdown has jolted industries like real estate and civil engineering. Meanwhile, high-tech fields continue to churn out new solutions, from advanced batteries to next-generation semiconductors. Observers sometimes paint China as a single chessboard with perfect coordination, but as Fishman notes, “China is not a country. It’s 23 country-sized provinces.” Each moves with partial autonomy and intense entrepreneurial energy, corralled just enough by state policy to target strategic goals.

According to Fishman, the pivot toward an innovation economy has a lot to do with the sheer numbers of engineers and research scientists being trained, then supported with state funding and incentives. That workforce no longer tinkers only with cheap assembly; they develop new battery chemistries, refine advanced reactor designs, and push manufacturing to ever-tighter tolerances. The prospect of a private firm “owning” the next leap in technology can mean everything from major political clout to a guaranteed home market of a billion consumers. It all feeds a cycle of rapid iteration and cost compression that few Western companies can match.

To fuel its economy, the country’s geology and geography shape energy priorities. China’s maritime trade routes remain vulnerable, so harnessing domestic resources—coal, wind, solar, and formidable rivers—brings a sense of security.

Take hydropower, for example. The Three Gorges Dam was once considered the pinnacle of Chinese hydropower ambition. Now, the country is planning an even larger project in Tibet, a series of run-of-river facilities meant to generate upwards of 45 GW. Unlike traditional hydro reservoirs, these won’t provide as much storage or dispatchability, but they will push coal further to the margins. Fishman emphasizes that while this project is a technical marvel, it also presents diplomatic challenges with downstream nations like India.

Coal, however, remains stubbornly persistent. Despite China’s leadership in renewables, coal-fired plants continue to be built, often funded by coal mining companies hedging their future. “These investors aren’t betting against renewables,” Fishman explains. “They’re betting against other coal plants.” He notes that many of these plants are ultra-supercritical units designed to undercut older, less efficient coal stations rather than expand total fossil fuel use.

“If you’re an investor building a coal plant in China today, you’re not betting against renewables. You’re betting against other coal plants.” – David Fishman

Batteries, on the other hand, are rewriting the rules of grid management. Once thought to be an afterthought in power planning, they are now a central pillar of China's energy strategy. Fishman describes China’s battery industry as a proving ground for ruthless industrial competition, where manufacturers constantly shave down costs and drive incremental efficiency gains. While the government recently relaxed mandates on pairing batteries with renewables, Fishman believes market forces will continue to drive large-scale battery deployment.

“Batteries are following the same trajectory as solar—first they were an afterthought, now they’re a necessity.” – David Fishman

All of this is unfolding against the backdrop of China’s first real economic slowdown in four decades. Growth has dipped from the staggering 10% annual gains of previous years to something closer to 3–5%. For any other country, that would still be robust, but in China, it feels like stagnation. Fishman argues that this shift represents a momentary correction rather than a long-term structural decline, as the economy transitions from rapid expansion to a more technology-driven model.

China’s model isn’t easily replicable. Its blend of state-driven investment, forced competition, and long-term planning is unique. But as the world wrestles with decarbonization, China’s success in electrification poses a stark question: Do Western markets need to rethink their aversion to state intervention in energy policy? Or will they continue to rely on China to make the tough bets, build the critical supply chains, and export the finished products? Fishman leaves us with a final thought: “If China had the U.S.’s geography and resources, with its system, it’d already be unstoppable.”

Chapters

00:00 Introduction

01:14 China's Electrification Journey

05:48 Hydropower in China

17:04 The Coal Conundrum

25:36 China's Massive Coal Power Expansion

27:44 China's Electricity Consumption Trends

32:27 Innovation in China's Energy Sector

40:08 The Future of Batteries and Green Hydrogen

Keywords

China’s energy transition, coal expansions, hydropower, energy security, innovation economy, grid-scale batteries, renewables, state capitalism, electrification, strategic policy

Share this post